How to Turn Everyday Business Payments into AMEX Travel Rewards

Jul 30, 2025

Table of Contents Running a business means spending money. That’s just part of it. Whether you’re managing a growing startup or a...

Running a business means spending money. That’s just part of it. Whether you’re managing a growing startup or a long-established firm, there’s always something to pay for — software subscriptions, wages, contractors, rent, tax, marketing, and everything in between.

Each week, cash flows out to keep things moving. And while that spend keeps your business running, it rarely gives you anything in return — aside from a few thank-you emails and payment receipts.

But what if it did?

What if every supplier invoice, rent payment, or tax bill could also earn you flights, hotel upgrades, and travel perks?

That’s exactly what the American Express Membership Rewards program can do. When you use the right AMEX card and the right tools, you can turn unavoidable business expenses into high-value travel rewards — without spending a dollar more.

In this guide, we’ll walk you through how it works:

Which AMEX cards give the best return

How to use your card to pay expenses that don’t normally allow credit cards

How to maximise points on everyday spend

And how Lessn helps unlock points from every payment

Why choose AMEX travel rewards for business?

There are plenty of rewards programs out there. But AMEX Membership Rewards stands out — especially for business owners.

Here’s why:

Flexible redemption

You can use your points to book flights, hotels, car hire and more directly through Amex Travel — or transfer them to over 20 airline and hotel partners like British Airways, Emirates, Qantas, Singapore Airlines, Marriott Bonvoy, and Hilton Honors.

Premium travel perks

AMEX business cards come with benefits that make business travel smoother and more enjoyable — from lounge access and concierge services to hotel upgrades and complimentary travel insurance.

Points never expire

As long as your account remains active and in good standing, your points won’t disappear — giving you time to save up for big redemptions.

High earn rates on business spend

Many AMEX business cards offer bonus point categories — like 4x or 5x points on flights, advertising, software, or dining — which means you’ll rack up points faster just by spending where your business already spends.

Learn more about AMEX Membership Rewards

Best AMEX business cards for travel rewards

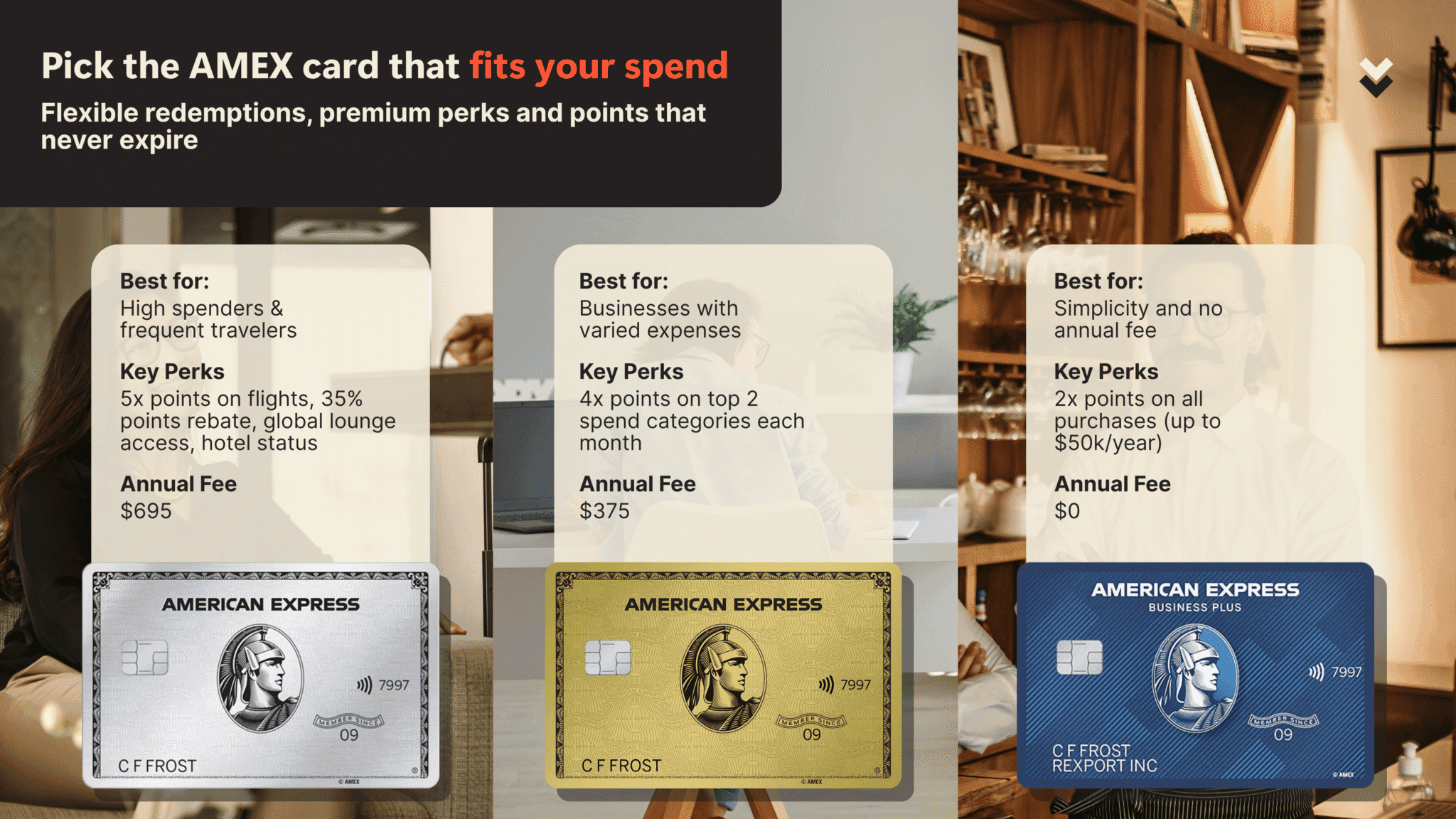

Not all cards are created equal. The best AMEX card for your business depends on how and where you spend. Here’s a comparison of three standout options:

Business Platinum is perfect if you travel regularly and want premium benefits like Centurion Lounge access, hotel status, and a hefty rebate when using points for flights.

Business Gold is great if your spending changes from month to month — it automatically applies 4x points to your top two eligible categories each billing cycle.

Blue Business Plus is a no-fee card that gives you 2x points on all spend (up to $50k annually), making it ideal for small businesses and side hustles that want simple, consistent rewards.

How to maximise points from everyday business payments

You don’t need to spend more to earn more. You just need to funnel your existing spend through the right card and tools.

Here are common business expenses that can earn AMEX Membership Rewards:

Marketing and advertising — such as Facebook Ads, Google Ads, and LinkedIn campaigns

Software and subscriptions — think Xero, QuickBooks, Canva, Adobe, Slack

Office equipment and supplies — including laptops, printers, stationery, or Amazon orders

Contractors and freelancers — when paid through platforms or intermediaries that accept cards

Meals and entertainment — client dinners, team lunches, or coffee meetings

Business travel — flights, hotels, taxis, car hire

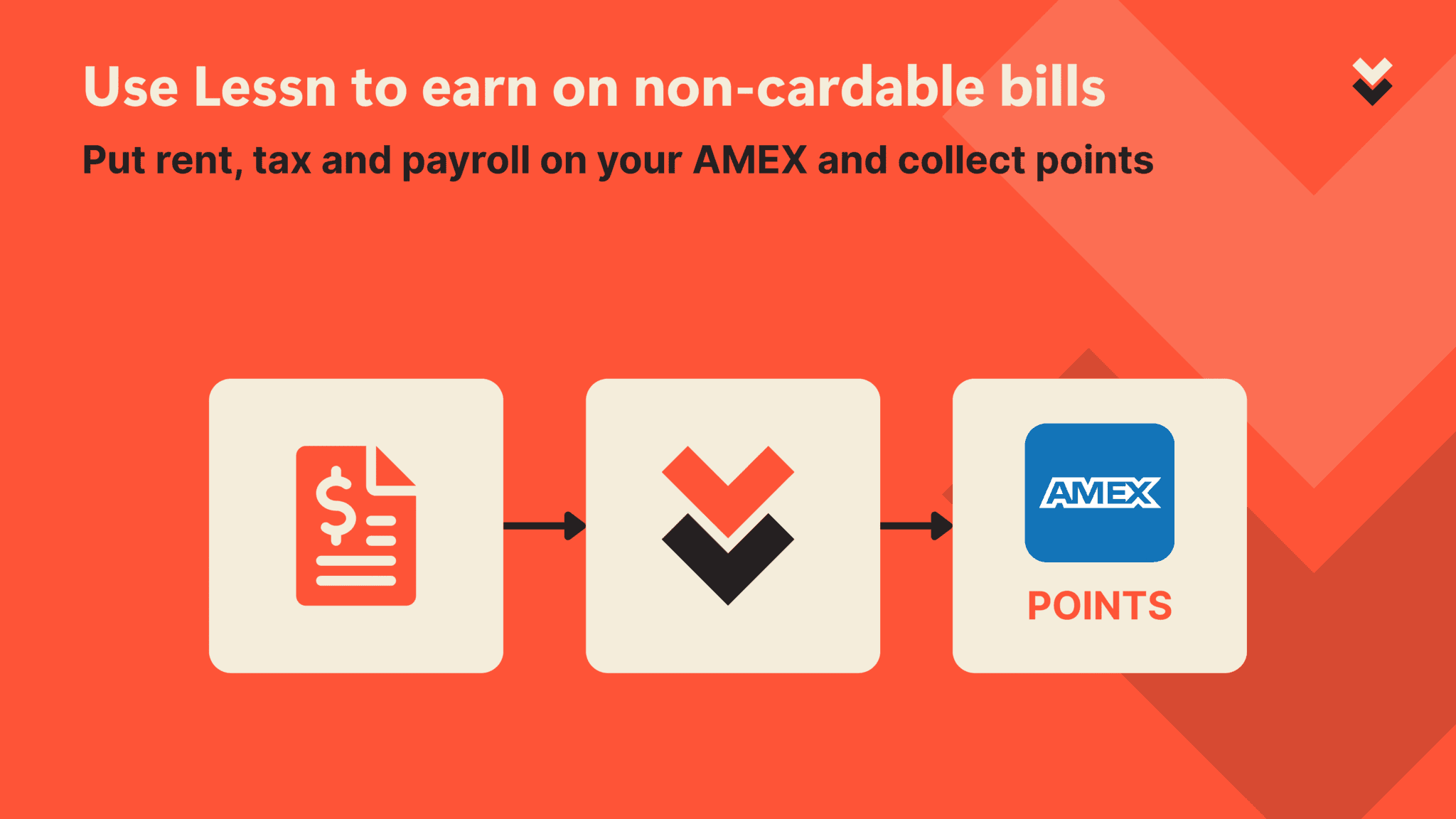

Rent, tax, and payroll — when paid using Lessn

Some of these expenses are naturally card-friendly. Others — like rent, ATO payments, or payroll — usually aren’t. But they make up a huge chunk of your annual spend.

This is where Lessn comes in, letting you use your AMEX card for payments that normally require bank transfers.

Optimising for bonus categories and sign-up offers

There are a few smart ways to accelerate your points:

Sign-up bonuses

Most AMEX cards offer generous welcome bonuses — sometimes 100,000+ points — if you meet a minimum spend in the first 3 months. Plan your card application around a big bill (like insurance or a software renewal) to hit the requirement easily.

Referral bonuses

AMEX rewards you for referring other business owners or colleagues. If they sign up using your link, you both get bonus points — simple and valuable.

Bonus categories

Cards like the Business Gold automatically apply 4x points to your highest spend categories (e.g. advertising, software, dining), meaning you don’t have to manually track or switch things around.

Amex Offers

Your account will often include targeted promotions offering extra points or discounts with selected merchants. Just log in, activate the offers, and enjoy the boost.

Guide to AMEX Business Platinum

Smart redemption strategies for maximum value

Not all redemptions are equal. If you want to get the most out of your Membership Rewards points, here’s how to do it:

✅ Transfer to airline or hotel partners

You’ll often get the best value per point when you transfer to travel partners like Qantas, Singapore Airlines, or Marriott — especially for long-haul or business class flights.

✅ Book business class or premium travel

Using points for premium cabins offers much better value than economy. A one-way business class ticket to Europe might cost 120,000 points but be worth $4,000+ in cash value.

✅ Use the 35% rebate (if on Business Platinum)

When you pay for flights through Amex Travel using points, you’ll get 35% of your points refunded for flights with your selected airline or any business/first-class booking.

❌ Avoid poor-value redemptions

Skip using points for gift cards, merchandise, or statement credits. These usually offer less than 0.5 cents per point — much lower than what you’d get with flights or hotel transfers.

AMEX transfer partners

NerdWallet: AMEX Redemption Tips

Lessn.io: Supercharging your business payments for rewards

The biggest blocker to earning more points isn’t spending. It’s how much of that spend goes to suppliers who don’t accept credit cards.

Lessn solves that.

It lets you earn full AMEX Membership Rewards points on payments that normally go through bank transfer — like rent, tax, super, and payroll.

Here’s how it works:

Pay any supplier — even if they only accept bank transfers

Use your AMEX card — and earn points as if it were a standard card payment

Suppliers receive a bank transfer — they don’t need to do anything different

Automate your accounts payable — upload invoices, set approval workflows, and schedule payments

Integrate with accounting tools — like Xero and QuickBooks

Extend cash flow — with up to 55 days to pay depending on your AMEX card’s billing cycle

Instead of leaving value on the table, Lessn helps you get rewarded for all the spend you already do.

Real-world example: turning $300K into a trip

Let’s say your business spends $300,000 a year on operating costs. That could include:

$100K on wages

$50K on rent

$30K on software

$25K on marketing

$20K on tax

$75K on freelancers, travel, insurance, and overheads

Now let’s say you route just half of that — $150,000 — through a 2x points AMEX card using Lessn.

That’s:

$150,000 × 2 points = 300,000 Membership Rewards points

What could 300,000 points get you?

Two return business class flights to Europe

A luxury hotel stay for a week in Singapore, Tokyo, or Dubai

A team offsite, flights included

Or a mix of flights, hotels, and upgrades

And all from expenses you were already going to pay anyway.

Pro tips and common mistakes

Here’s how to maximise your setup — and what to watch out for.

✅ Do:

Plan large expenses around sign-up bonuses

Time your application before a major bill to unlock welcome offers with ease.

Consolidate employee card spend

Give your team supplementary cards and have all points roll into one account. You’ll reach redemptions faster and simplify tracking.

Use Lessn for non-cardable expenses

Your biggest expenses are often the ones you can’t put on a card. Lessn unlocks that spend so you can earn points on rent, tax, and payroll.

Review your redemption plan regularly

Airline rewards charts change. Don’t let points sit idle — check in every few months to plan smart redemptions and avoid devaluations.

❌ Avoid:

Redeeming for gift cards or merchandise

It’s tempting, but the point value is low — often under 0.5c per point.

Letting points expire

While AMEX points don’t expire as long as your account is active, they’ll vanish if you close your account or let it lapse.

Hoarding points without a plan

Points don’t grow in value. They often devalue over time. Use them when the opportunity makes sense — especially for premium travel.

Business Insider: Worst Ways to Redeem

Ready to earn more from your business spend?

If you’re already spending thousands each month to keep your business running, why not get something back?

By pairing the right AMEX card with Lessn, you can:

Turn large non-cardable expenses like rent and tax into points. Even payments that typically require EFT or BPAY can now earn full AMEX points.

Earn hundreds of thousands of Membership Rewards points each year. Just redirecting 50% of your spend through a 2x card could earn you 300,000 points a year.

Book business-class flights and luxury hotels with points, not cash. Make every trip more enjoyable — or free.

Get access to lounges, upgrades, and other perks. Enjoy premium travel experiences just by using the right card.

Automate and streamline payments. Save time, reduce manual data entry, and stay on top of cash flow with built-in approval workflows.

Improve cash flow with up to 55 days to pay. AMEX’s billing cycle gives you more breathing room on big payments — without interest.

Try Lessn today and turn everyday business expenses into first-class travel rewards.

Frequently Asked Questions About Earning AMEX Travel Rewards on Everyday Business Expenses

How can I use my AMEX card to pay for rent, tax and payroll if those vendors don't take card?

You can still earn points on non-cardable expenses using Lessn. It lets you pay any supplier via your AMEX card—even if they only accept bank transfers. Lessn processes the card payment on your end, and your supplier receives a standard bank transfer on theirs. That way, you earn full Membership Rewards points on rent, tax, payroll, and other large payments that wouldn’t usually be eligible.

Which AMEX business card earns the most travel points for small to midsize businesses?

It depends on your spending style. For simplicity, the Blue Business Plus earns 2x points on all purchases up to $50k per year. The Business Gold gives 4x points on your two top spending categories each month. And if you’re after lounge access, hotel status, and a 35% rebate on flight redemptions, the Business Platinum is a premium option tailored for frequent travelers.

Is it really possible to earn 300,000 AMEX points a year just from my existing business spend?

Yes — and you don’t need to spend more to get there. Let’s say your business already spends $300,000 a year. If you redirect just half of that ($150,000) through a 2x AMEX card using Lessn, you could earn 300,000 points annually. That’s enough for return business class flights to Europe or a luxury hotel stay in Asia — all from expenses you were going to pay anyway.

What's the smartest way to use AMEX Membership Rewards points for maximum value?

The highest value comes from transferring points to airline and hotel partners. For example, 120,000 points might book you a one-way business class ticket to Europe worth $4,000+. Booking premium cabins or transferring to partners like Qantas or Marriott usually gives you 1–3 cents per point, compared to under 0.5 cents per point for gift cards or merchandise.

What common mistakes should I avoid when trying to earn and redeem AMEX points?

Avoid using points for gift cards, merchandise, or statement credits — these typically offer poor value. Don’t let points sit idle either; although they don’t expire if your account is active, they may devalue over time. And remember to activate Amex Offers to unlock bonus points with select merchants — it’s an easy way to boost earnings.

Continue Reading

START REWARDING YOUR HARD WORK TODAY

Join Australian businesses turning payments into rewards.